What the Federal ITC Extension Means for the US Energy Storage Market

March 29, 2016 | posted by The Institute

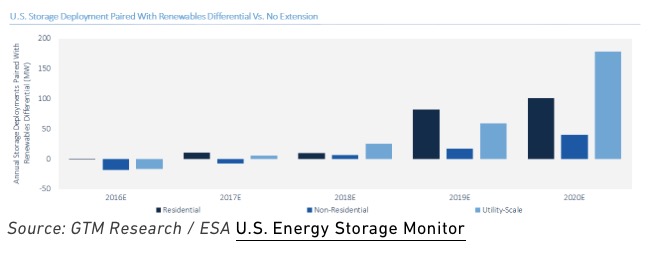

While an obvious boon for the U.S. solar market, the recent extension of the federal Investment Tax Credit may also offer a promising boost to the U.S. energy storage market. According to the recently released U.S. Energy Storage Monitor, GTM Research expects an additional half a gigawatt of storage paired with renewables to come on-line between 2016 and 2020, compared to a scenario with no tax credit extension.

Though storage alone doesn’t qualify for the ITC, if installed with solar PV or wind, energy storage systems historically have been able to claim tax credits, as long as they meet certain requirements. As such, the 30 percent tax credit will create a significant opportunity for energy storage suppliers that are active in the U.S. market.

Of the additional half-gigawatt of storage driven by the ITC, most deployments will be in the utility-scale segment; however, the non-residential and residential segments will benefit as well.

In fact, GTM Research ran an economic analysis for a hypothetical residential solar-plus-storage system in Hawaii. It found that the ITC doubled the system’s internal rate of return and decreased the payback period from 12 years to just four years.

While the IRS requirements on eligibility of storage paired with renewables have been fairly ambiguous, it was a promising sign when the Department of the Treasury and the IRS opened the door for explicit inclusion of renewables paired with storage through a notice last fall.

"Both the Department of the Treasury and the IRS are deliberating over whether storage should automatically qualify for the ITC," said Ravi Manghani, a senior energy storage analyst with GTM Research. “If renewables-paired storage does become explicitly eligible, there is an even more significant upside for projected deployment in the coming years.”